Only 8% of MPs think raising taxes alone is the answer, new polling shows – most back fiscal rule reform as Reeves faces Budget test

Recent comments by former Bank of England Chief Economist Andy Haldane have reignited debate about whether the UK’s fiscal rules are fit for purpose. Writing in the Financial Times, Haldane described the current framework as a “Brexit tribute act” – a system so rigid that it risks repeating the same policy uncertainty and drag on growth seen after the 2016 referendum.

In his view, just as Brexit-era politics unsettled businesses and households through constant uncertainty about the UK’s future direction, today’s tight fiscal rules are creating a similar cycle of hesitation. In practice, many UK Budgets are preceded by heavy public speculation about tax rises or spending cuts – and often by a delay until the OBR’s official forecasts are published before the government’s available fiscal headroom is fully visible – a process that further delays decisions and undermines confidence and investment.

Survation polling of MPs, commissioned by the Economic Change Unit, suggests that concern about the fiscal framework extends well beyond economists.

A cross-party view that the current rules make delivery harder

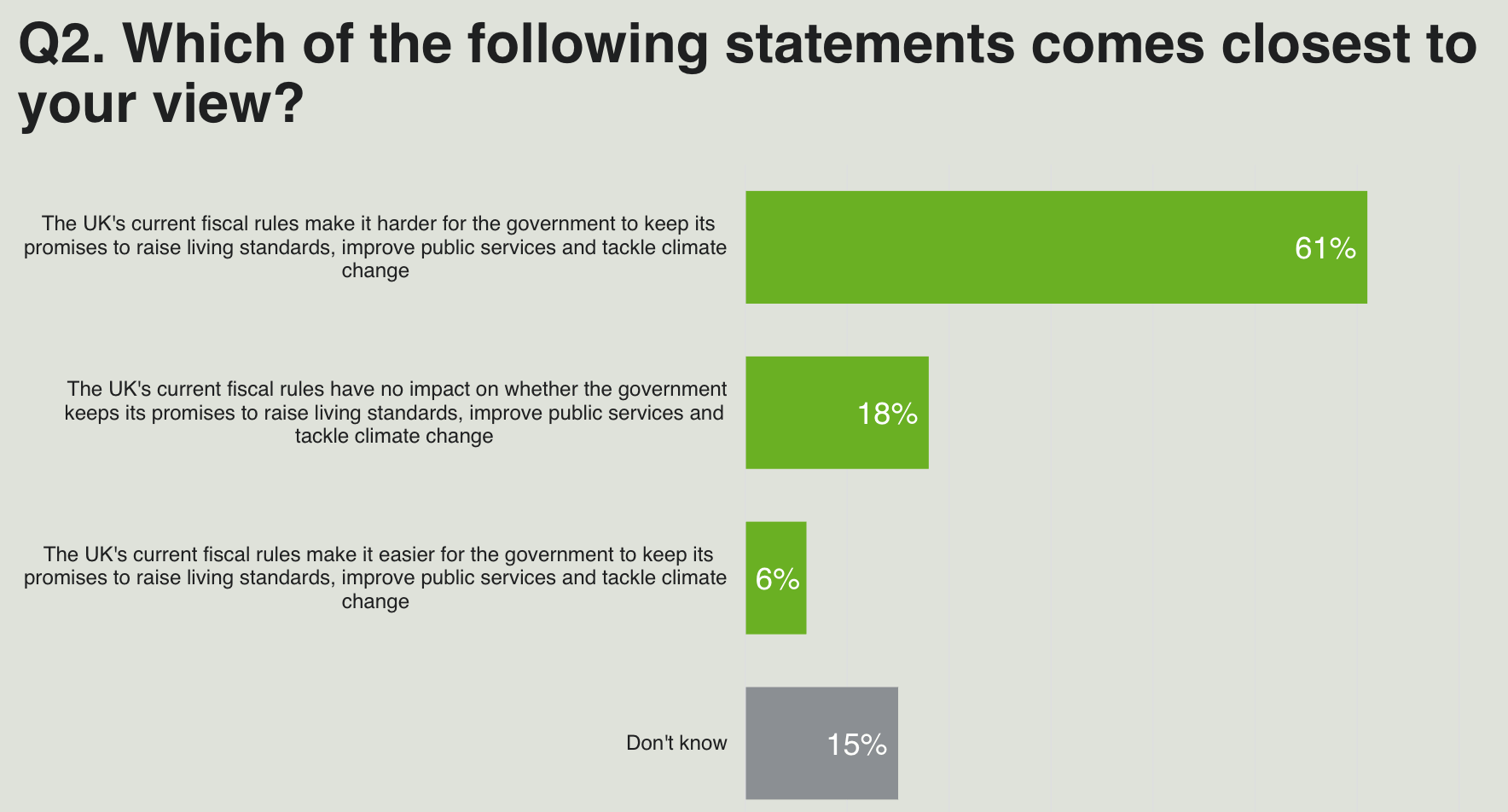

A majority of MPs surveyed said the UK’s fiscal rules make it harder for government to meet its commitments to raise living standards, improve public services and tackle climate change. Only a small proportion felt the rules make delivery easier, and most MPs supported some form of reform – whether loosening the rules, modernising their design, or increasing headroom for public investment.

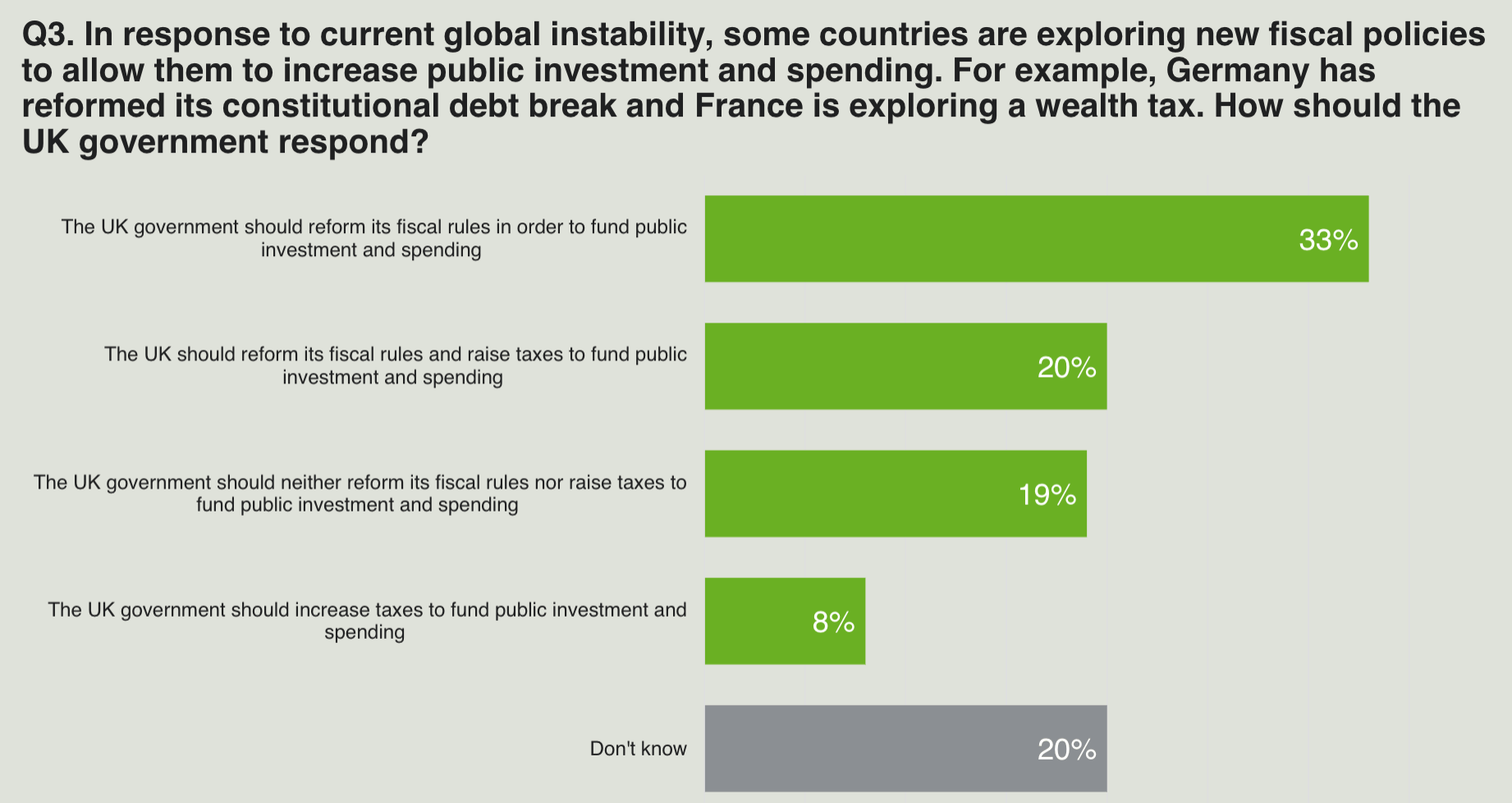

Interestingly, only 8% of MPs said the UK government should raise taxes alone to fund higher public investment. The clear majority preferred reforming the fiscal rules, either with or without tax changes. This indicates that MPs see the structure of the fiscal framework itself – rather than tax levels – as a key constraint on investment and growth.

These findings suggest that among parliamentarians there is growing recognition that the current fiscal approach may be constraining rather than enabling effective policy.

Echoes of Haldane’s critique

In his FT column, Haldane argued that fiscal policy has become “an inhibitor, not enabler, of growth.” He warned that overly tight rules – combined with minimal fiscal headroom of just 0.3% of GDP – amplify uncertainty and make the UK economy less resilient to shocks.

The Economic Change Unit’s polling indicates that many MPs share this concern. While the motivations differ by party, the underlying theme is consistent: the existing fiscal framework may be too inflexible to support the government’s economic and social objectives.

An evolving debate on fiscal policy

The UK’s fiscal debate has long revolved around the balance between credibility and flexibility. Haldane’s intervention – and MPs’ responses – point to a potential shift in that balance. There is growing interest in frameworks that provide stability and allow space for investment in infrastructure, public services and climate action.

Revisiting the design of fiscal rules need not imply abandoning discipline. Rather, it reflects a broader question: how can fiscal policy best contribute to long-term growth, resilience and the transition to a fairer, greener economy?

About the polling

The findings come from Survation’s latest MP Panel survey conducted for the Economic Change Unit in 2025. MPs were asked about the government’s spending plans, the effects of fiscal rules on delivery, and possible reforms to support investment and growth.

Context

The new data follows a statement last year from a group of leading UK economists – including Lord O’Donnell, Lord O’Neill, Mariana Mazzucato and Mohamed El-Erian – calling for an overhaul of Britain’s fiscal rules to enable higher levels of public investment. Together, these interventions suggest a widening consensus that the UK’s fiscal framework may need to evolve to support stronger, more sustainable growth.

Get The Data

Data tables can be found here:

To learn more or discuss your next project, contact our team at researchteam@survation.com.

For client services, contact John Gibb on 0203 818 9661, or view our services.

________________________________________

Survation. is an MRS company partner, a member of the British Polling Council and abides by their rules. To find out more about Survation’s services, and how you can conduct a telephone or online poll for your research needs, please visit our services page.

For press enquiries, please call 0203 818 9661 or email media@survation.com

< Back